In FY2020, HDB launched 3 Build-To-Order (BTO) exercises in August and November 2020, and February 2021. While HDB typically holds 4 BTO exercises a year, the May 2020 launch was deferred to the following quarter in view of circuit breaker measures. Overall, the BTO flat supply in the last FY comprised 25 projects with 17,397 highly subsidised flats across mature and non-mature towns.

HDB offered another 5,220 flats for sale under the Sale of Balance Flats (SBF) exercise. In addition, 807 flats were available for open booking, a sales mode introduced in FY2019 to help buyers get a home more quickly. Under this sales mode, buyers can submit an online application and select a unit as early as the next working day.

Eligible home buyers, particularly first-timers, continue to enjoy generous housing grants to help them with the purchase of their HDB flat.

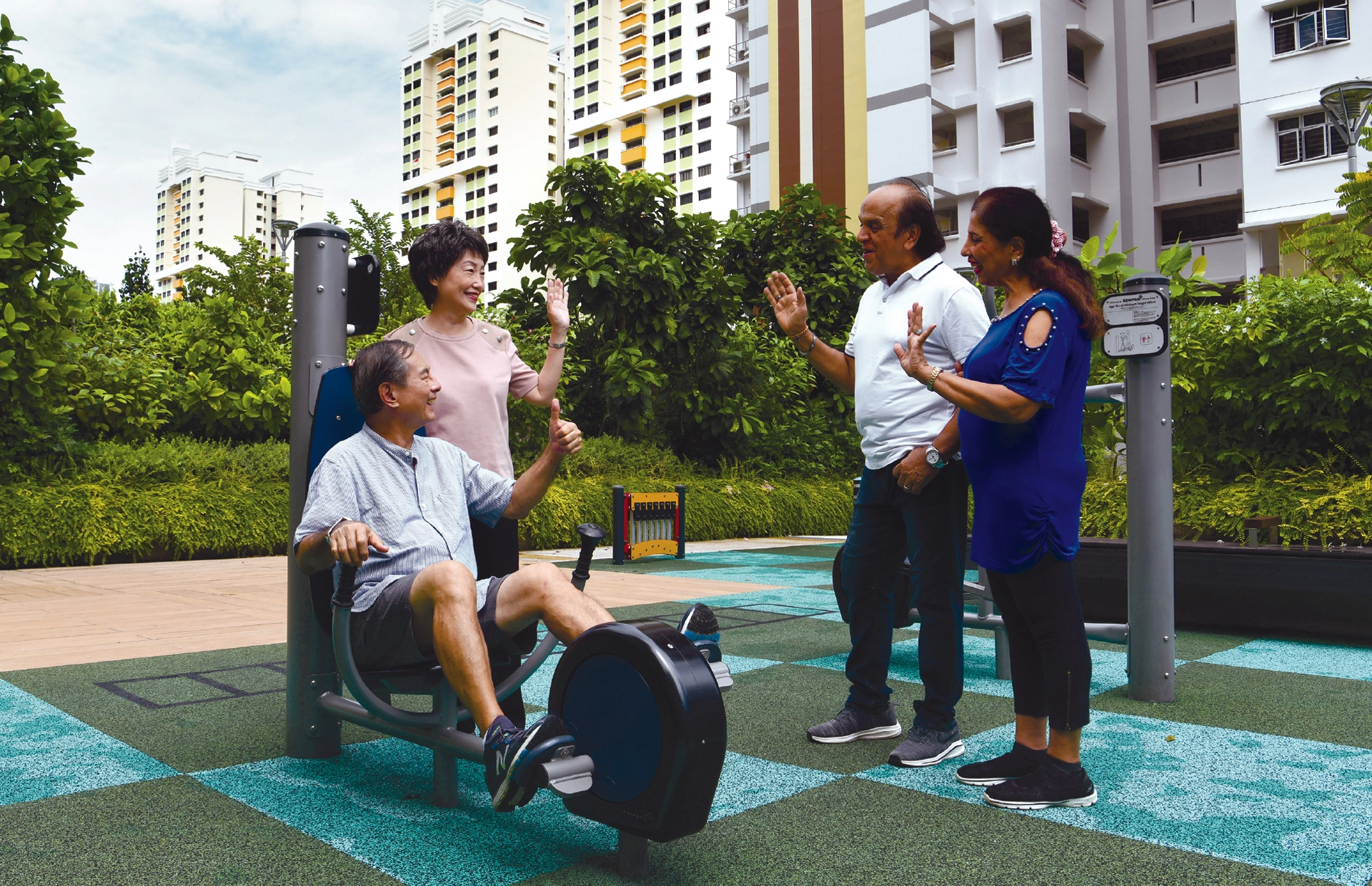

HDB has various housing and monetisation options in place to help seniors age independently and confidently

More housing support for seniors

The Community Care Apartments (CCAs), a new public housing concept for seniors jointly developed by HDB, Ministry of National Development (MND) and the Ministry of Health (MOH), were launched during the February 2021 BTO exercise.

The CCAs expand the continuum of residential options for seniors today. It supports seniors who wish to live independently in their golden years within the community, by providing them with homes that integrate senior-friendly design features with care services that can be scaled according to their individual needs. At each level of the block is a furnished communal space for residents to mingle, bond and engage in social activities.

For seniors who wish to age-in-place in their current homes, HDB provided greater support for them to monetise their flat, with the enhancement of the Lease Buyback Scheme (LBS). LBS allows elderly owners to sell part of their flat’s lease to HDB to supplement their retirement income. From 1 April 2020, the maximum LBS bonus quantum for home owners of 3-room or smaller flats, 4-room flats, and 5-room or larger flats was increased by 50 percent to $30,000, $15,000 and $7,500 respectively.

Enhancing the flat buying process

To make it more convenient for flat buyers and sellers, HDB launched the HDB Flat Portal in January 2021 as part of its efforts to streamline and simplify the process of buying and selling HDB flats. The main features of the portal include listings of current and upcoming new flats, customised financial calculators for buyers and sellers, as well as a loan-listing service with information on housing loans offered by HDB and participating financial institutions.

For flat buyers wanting to get a better sense of the interior of a flat, the newly revamped show flats at the My Nice Home Gallery feature fresh interior design ideas including work-from-home elements and smart devices. Flat buyers can experience a virtual walk-through of the show flats and visualise the design potential of their homes.

Working hard to keep projects on track

A total of 8,234 flats were completed in this FY. Of these, 7,117 were BTO units, including the first 2 smart-enabled precincts in Punggol Northshore which incorporated smart technologies in its planning, design, and estate maintenance. Another 810 units under the Selective En bloc Redevelopment Scheme (SERS), and 307 rental flats were also completed.

As of 31 March 2021, 75,322 BTO, SERS and rental flats are under construction. With building supplies and manpower disruptions brought about by the COVID-19 pandemic, coupled with Safe Management Measures at construction sites, most of HDB’s building projects will take a longer time to complete. To make up ground, HDB put in place mitigating measures and has been working hard to keep BTO projects on track, while ensuring that the safety and well-being of workers, and the quality of the projects would not be compromised. HDB kept in touch with flat buyers and updated them regularly on the revised completion dates. Affected parties who were unable to find alternative housing arrangements were also offered assistance by HDB where possible.

Assistance for vulnerable groups

With the COVID-19 pandemic impacting Singapore’s economy, HDB introduced measures to help home owners who might need assistance with their mortgage payments:

- Suspension of late payment charges from April 2020 till September 2021

- Waiver of mortgage interest on a temporary basis under the Reduced Repayment Scheme or Deferment Scheme

- Extension of repayment period for instalment plan beyond the previous maximum allowable period of 5 years

- Extension of the mortgage loan tenure beyond the previous maximum allowable period of 30 years, subject to a 65-year age ceiling

From January 2020 to March 2021, more than 5,976 households benefited from various financial assistance measures.

The Home ownership Support Team (HST), set up in December 2019 to support public rental households in their journey towards home ownership, has engaged 654 rental households as of the end of 2020. 227 households were assessed to be ready for home ownership within the next 2 years, of which 23 had either collected keys or moved into their new homes.