Financial Results

HDB provides Singaporeans with affordable homes and a quality living environment, through its role as the master planner and developer of Singapore’s public housing towns and estates.

To help Singaporeans become home owners, the Government subsidises HDB flats with price discounts for new flats and by offering a variety of housing grants. HDB also offers housing loans at concessionary interest rates to help eligible Singaporeans own their homes. For needy, low income Singaporeans, HDB provides heavily subsidised rental flats.

To ensure that HDB towns continue to be renewed and cater to the changing needs of residents, HDB rejuvenates its towns and flats through programmes such as the Remaking Our Heartland (ROH) Programme, Home Improvement Programme (HIP), Neighbourhood Renewal Programme (NRP), and Lift Upgrading Programme (LUP). In addition, HDB develops and manages commercial properties like neighbourhood centres to provide a range of amenities and employment opportunities in HDB towns.

To reflect the full spectrum of HDB’s operations, the financial results are presented under ‘Housing’ and ‘Other Activities’ in the audited financial statements. ‘Housing’ consolidates the results of housing programmes implemented. It comprises the Home Ownership, Upgrading, Residential Ancillary Functions, Rental Flats, and Mortgage Financing segments. ‘Other Activities’ comprises the Other Rental and Related Businesses segment, and Agency and Others segment which are commercial in nature.

In Financial Year (FY) 2019/ 2020, HDB incurred a net deficit of $2,665 million, before the government grant, as compared with $1,986 million in FY 2018/ 2019. The net deficit comprised the deficit from the ‘Housing’ activities of $3,111 million, offset by the surplus from the ‘Other Activities’ of $446 million in FY 2019/ 2020.

HDB received a grant of $2,692 million in FY 2019/ 2020 from the Government to finance its deficit, and to protect the reserves of the past governments in accordance with the Constitution of the Republic of Singapore. The retained earnings of HDB as at 31 March 2020 remained at zero after the transfers to the capital gains reserve to protect past reserves.

Housing Results

The Home Ownership segment covers the development and sale of flats to eligible buyers under the various home ownership schemes for public housing. The Home Ownership segment reported a deficit of $2,232 million in FY 2019/ 2020 as compared with $1,421 million in FY 2018/ 2019.

HDB recorded a lower gross loss of $721 million for the sales completed (i.e. keys issued to buyers) in FY 2019/ 2020. The number of sales completed in FY 2019/ 2020 was 11,609 units as compared with 16,608 units in FY 2018/ 2019.

The provision for foreseeable loss of $659 million that was made in the previous years was released on the completion of the sale of flats in FY 2019/ 2020. On the other hand, $1,477 million of additional foreseeable loss was provided mainly for the new building contracts awarded. As a result, there was a net increase of $818 million in the provision for foreseeable loss.

HDB also disbursed $631 million of CPF housing grants to eligible buyers of resale flats and Executive Condominiums (ECs) in FY 2019/ 2020 as compared with $532 million in FY 2018/ 2019.

The Upgrading segment reported a deficit of $440 million in FY 2019/ 2020. The programmes are the Home Improvement Programme, Neighbourhood Renewal Programme, and Lift Upgrading Programme for housing estates. The decrease in the deficit was due to a lower expenditure for the Home Improvement Programme, as compared to last year.

The Residential Ancillary Functions segment includes lease administration, provision and management of ancillary facilities such as car parks in housing estates, and planning and building administration. It reported a deficit of $312 million in FY 2019/ 2020.

The Rental Flats segment recorded a slightly lower deficit of $115 million in FY 2019/ 2020.

The Mortgage Financing segment also recorded a lower deficit of $21 million in FY 2019/ 2020.

Results of Other Activities

The segment on Other Rental and Related Businesses focuses on the provision, tenancy, and management of commercial properties and land. It reported a lower surplus of $454 million in FY 2019/ 2020, due mainly to rental rebates given to qualifying tenants in HDB shops and social-communal facilities. The rental rebates were given to help businesses cushion the impact of COVID-19.

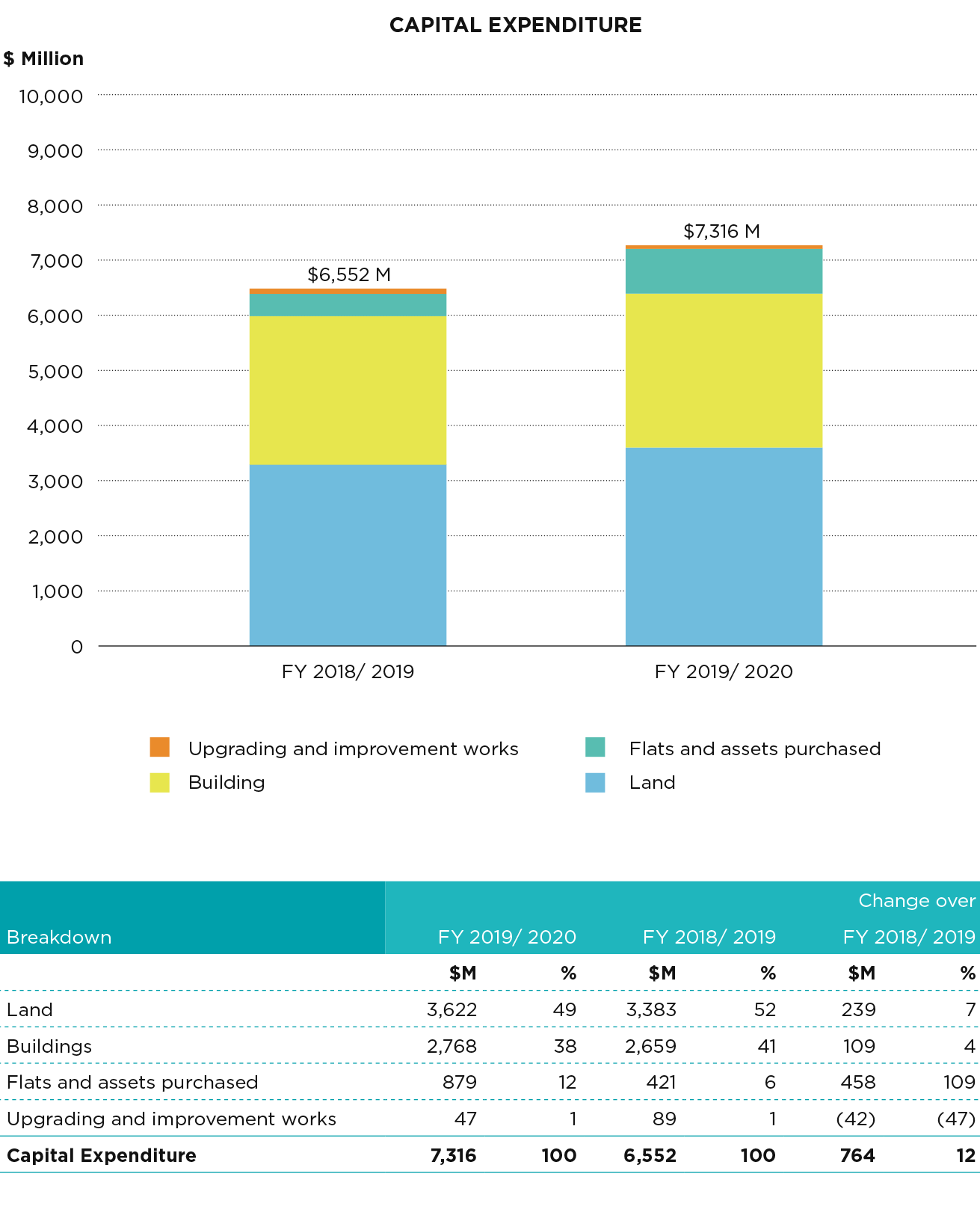

Capital Expenditure

Capital expenditure for the year was $7,316 million. A large proportion of the year’s capital expenditure was incurred for the purchases of land and construction of public housing.

Financial Position

As at 31 March 2020, HDB’s total assets amounted to $87,441 million. Loans receivable were $40,279 million. Property, plant and equipment, investment properties, and properties under development and for sale were $42,546 million. Altogether these assets accounted for 95% of the total assets.

Capital and reserves stood at $15,230 million as at 31 March 2020. Reserves comprised capital gains reserve of $7,432 million and asset revaluation reserve of $5,334 million.

The loans payable of $66,205 million comprised mainly loans from the Government and bonds.

Financing of Public Housing

HDB’s annual deficit is fully covered by a government grant. In addition, HDB receives a government grant to preserve the capital gains attributable to past governments on disposal of the protected assets, in accordance with the Constitution of the Republic of Singapore. The cumulative government grants provided to HDB since its establishment in 1960 amounted to $36,226 million.

The main loans which finance HDB’s operations comprise:

i) Mortgage financing loans that finance the housing loans granted by HDB to purchasers of flats under the public housing schemes.

ii) Housing development loans that finance the development programmes and operations.

iii) Bonds that finance HDB’s development programmes, working capital requirements, and refinancing of existing borrowings. During the year, HDB raised $3.20 billion and redeemed $1.83 billion of unsecured Fixed Rate Notes. Total outstanding Notes under the Medium Term Note Programme was about $24 billion as at 31 March 2020.